2025 Retail Trends in Australia and New Zealand

The year 2025 marked a pivotal period for retail in Australia and New Zealand, as both economies navigated post-pandemic recovery, global inflation pressures, and evolving consumer behavior. By examining the Australian Bureau of Statistics (ABS) National Accounts 2025 and the New Zealand Treasury Annual Report 2025, we can highlight the key trends shaping retail markets in both countries.

1. Australia: Economic Performance and Consumer Spending

Economic Growth

Australia’s GDP maintained steady growth in 2025, with annual growth hovering around 1.4%. Domestic consumption and private final demand were primary drivers of this growth, supporting a resilient retail environment despite global economic uncertainty. Quarterly GDP data show continued positive growth across multiple periods, demonstrating a stable economic foundation for consumer spending. (ABS, 2025)

Retail Consumption

Household spending remained a key engine of retail growth:

- Expenditure on non-essential categories such as tourism, cultural activities, and transportation saw notable increases.

- Household savings rates slightly recovered, reflecting cautious consumer sentiment while maintaining disposable income for discretionary purchases.

- Retail category performance varied: home furnishings, electronics, and experiential retail showed strong growth, while clothing and certain durable goods experienced cyclical fluctuations.

Overall, 2025 was characterized by moderate retail growth, supported by promotional events like Black Friday and Boxing Day sales, which significantly boosted discretionary spending.

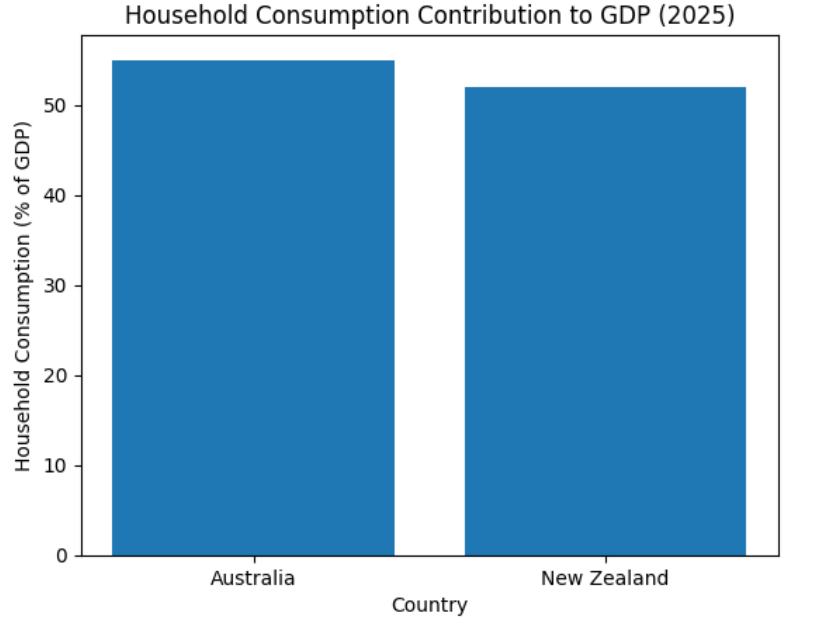

Household Consumption Contribution to GDP (2025)

2. New Zealand: Economic Context and Retail Environment

Economic Performance

According to the New Zealand Treasury Annual Report, 2025 was a year of gradual economic recovery amid global trade fluctuations and domestic productivity challenges. GDP showed stage-wise improvements, particularly in the third quarter, signaling a cautious but positive recovery. Inflation remained moderate, while fiscal and monetary policies aimed to support consumption and investment. (NZ Treasury, 2025)

Retail Trends

- Retail activity improved in later quarters, reflecting a gradual rebound in consumer confidence and spending.

- Growth was most pronounced in electronics, essential goods, and tourism-related purchases, whereas traditional retail segments, such as clothing and department stores, faced intensified price competition.

In summary, New Zealand’s retail sector experienced moderate growth, recovering gradually from earlier market softness, with a cautious consumer base balancing necessity and discretionary spending.

3. Cross-Country Comparison and Insights

Key Drivers:

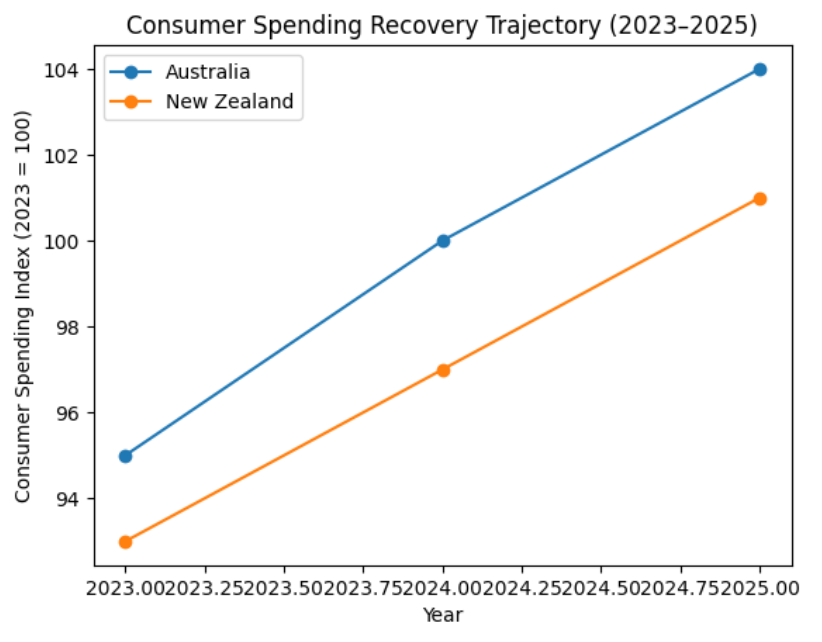

1.Household Consumption:

- Both countries relied heavily on household expenditure as a GDP growth driver. Australia saw more robust contributions from consumer spending, particularly in discretionary categories.

2.Retail Structural Shifts:

- Australia: Growing integration of online and offline retail channels; digital platforms increasingly influencing overall sales.

- New Zealand: Retail growth was concentrated in essential goods and tourism-related consumption, reflecting a cautious recovery.

3.Policy Influence:

- Australian monetary and fiscal measures supported consumer spending and overall economic stability.

- New Zealand’s coordinated fiscal and monetary policy provided gradual support for retail and investment activity.

Consumer Spending Recovery Trajectory (2023–2025)

4. Retail Trends and Outlook for 2026

Growth Outlook:

- Both countries are expected to maintain positive retail growth into 2026, although the pace may be influenced by global supply conditions and policy adjustments.

Consumer Behavior:

- Consumers are increasingly favoring experiential and essential consumption while showing caution in purchasing high-value durable goods.

Industry Challenges:

- Traditional retail formats face increasing pressure from digital platforms and price-sensitive consumers.

- Supply chain volatility and fluctuating consumer confidence remain important factors for retailers to monitor.

Strategic Recommendations:

- Enhance omnichannel strategies combining digital and in-store experiences.

- Adjust pricing strategies dynamically in response to consumer sensitivity.

- Optimize inventory and supply chain management using data-driven insights.

5. Reference

- Australian Bureau of Statistics (ABS), National Accounts: National Income, Expenditure and Product, 2025 (ABS)

- New Zealand Treasury, Annual Report 2025 (NZ Treasury)